We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

close

Press esc to close

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information

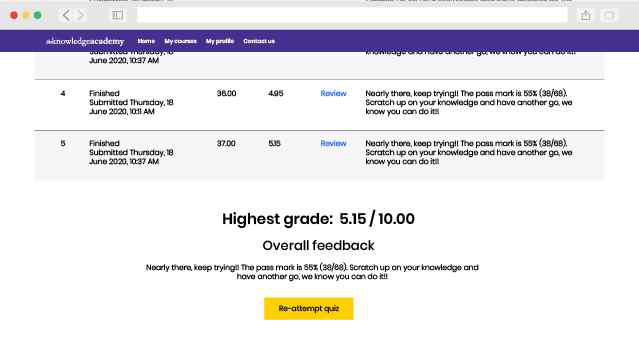

Module 1: What is Credit Control?

Module 2: Why is Credit Control Important and What is its Purpose?

Module 3: Impact of Debt

Module 4: Credit Assessments

Module 5: Collection Process

Module 6: Becoming a Credit Controller

This Introduction to Credit Control Training Course is designed for individuals who are looking to enhance their understanding in the concepts of Credit Control and its role in Financial Management. This course will benefit the following professionals:

There are no formal prerequisites to attend this Introduction to Credit Control Course.

The Introduction to Credit Control Course is a foundational educational course designed to impart essential knowledge and skills in managing and controlling credit, both in personal finance and in business settings. This course typically covers the basics of credit management, including understanding credit terms, assessing creditworthiness, and effective strategies for credit collection.

The benefits of learning Introduction to Credit Control are multifaceted. For individuals, it offers the knowledge needed to manage personal credit effectively, helping to improve financial stability and credit ratings. For professionals working in finance, banking, or business, it equips them with the necessary skills to assess and manage credit risk, enhance cash flow, and minimise bad debt.

The 1-day Introduction to Credit Control Course itself offers specific benefits to its participants. It provides a structured learning environment, often with expert instructors who have real-world experience in credit management. This course includes case studies, practical exercises, and interactive sessions, making the learning process engaging and applicable to real-life scenarios.

Course Objectives:

This course is designed to provide a comprehensive understanding of credit control, equipping participants with practical skills and theoretical knowledge. It aims to develop proficiency in managing credit effectively, ensuring both personal and business financial stability and growth while adhering to legal and ethical standards in credit management.

Why choose us

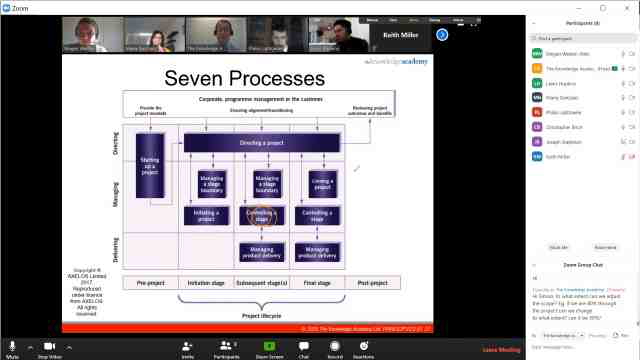

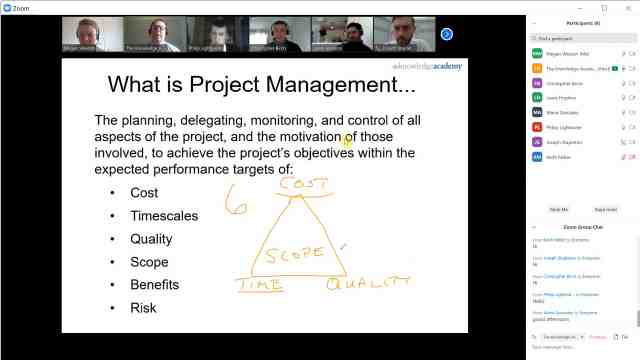

Our easy to use Virtual platform allows you to sit the course from home with a live instructor. You will follow the same schedule as the classroom course, and will be able to interact with the trainer and other delegates.

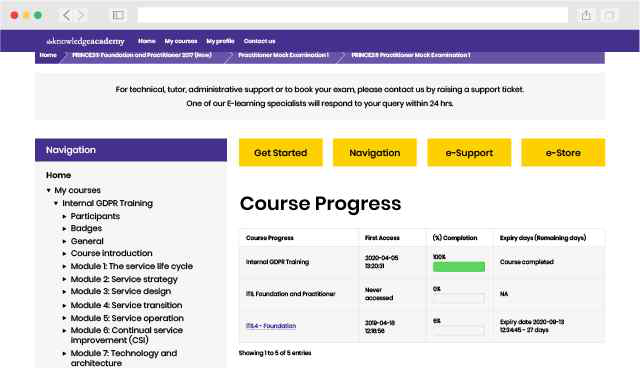

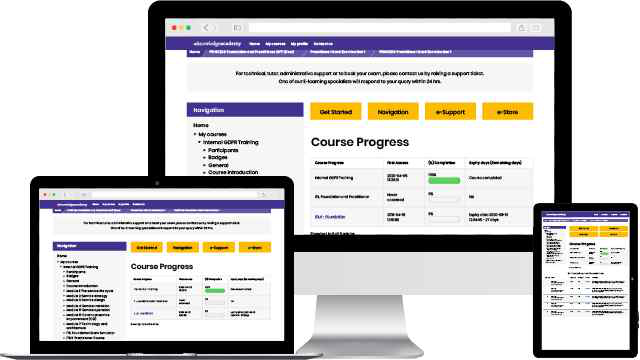

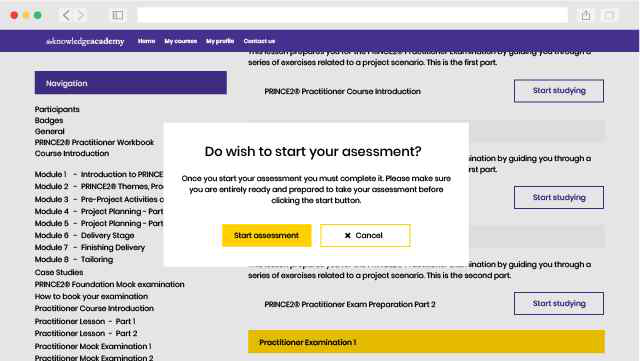

Our fully interactive online training platform is compatible across all devices and can be accessed from anywhere, at any time. All our online courses come with a standard 90 days access that can be extended upon request. Our expert trainers are constantly on hand to help you with any questions which may arise.

This is our most popular style of learning. We run courses in 1200 locations, across 200 countries in one of our hand-picked training venues, providing the all important ‘human touch’ which may be missed in other learning styles.

All our trainers are highly qualified, have 10+ years of real-world experience and will provide you with an engaging learning experience.

We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction-free as possible

We limit our class sizes to promote better discussion and ensuring everyone has a personalized experience

Get more bang for your buck! If you find your chosen course cheaper elsewhere, we’ll match it!

This is the same great training as our classroom learning but carried out at your own business premises. This is the perfect option for larger scale training requirements and means less time away from the office.

Our courses can be adapted to meet your individual project or business requirements regardless of scope.

Cut unnecessary costs and focus your entire budget on what really matters, the training.

This gives your team a great opportunity to come together, bond, and discuss, which you may not get in a standard classroom setting.

Keep track of your employees’ progression and performance in your own workspace.

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on 01344203999 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!