We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

close

Press esc to close

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information

Module 1: Introduction to Payroll

Module 2: Payroll Obligations and Requirements

Module 3: Payroll Cycle

Module 4: PAYE

Module 5: Tax Codes and Tables

Module 6: Statutory Sick Pay

Module 7: Statutory Maternity

Module 8: Pensions and Student Loans

Module 9: Student Loans

Module 10: Reports and Record Keeping

This Introduction to Payroll Course is designed for individuals seeking to develop their understanding in the fundamentals of Payroll. This course will benefit professionals, including:

There are no formal prerequisites to attend this Introduction to Payroll Course.

This Introduction to Payroll course offers an essential overview of payroll management, which is a critical aspect of business operations. This course covers the basics of calculating wages, managing employee records, understanding legal compliance, and processing payroll taxes and deductions. It is designed to equip learners with the foundational knowledge required to effectively manage and oversee the payroll function in a business.

The benefits of an Introduction to Payroll Course extend beyond mere operational knowledge. Firstly, it empowers individuals with the skills necessary for accurate and efficient payroll processing, which is vital for employee satisfaction and legal compliance. Secondly, the course enhances one’s understanding of financial principles related to payroll, such as tax implications and budgeting for salaries.

The Knowledge Academy's Introduction to Payroll Course offers specific benefits that are instrumental for career growth and development in the field of human resources and finance. Participants gain practical skills that are immediately applicable in the workplace, enhancing their job prospects and professional credibility. This course is particularly beneficial for those aspiring to roles in HR, accounting, or small business management, as it provides a solid foundation in a key area of business operations.

Course Objectives:

The course aims to equip learners with both theoretical and practical insights into payroll management. It is designed to provide a thorough understanding of the complexities involved in payroll processing, legal compliance, and the use of modern technology, thus preparing participants for effective and efficient payroll administration in various business settings.

Why choose us

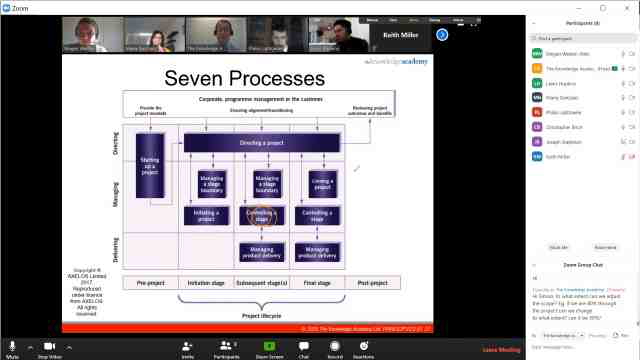

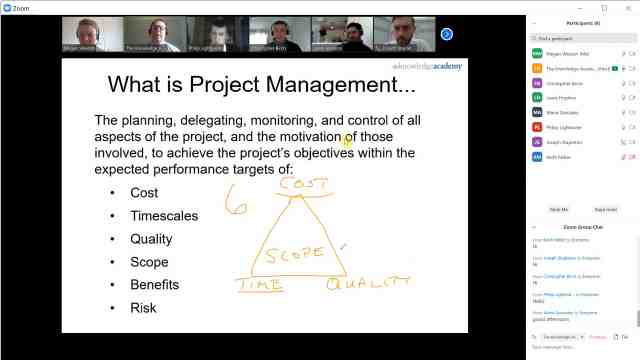

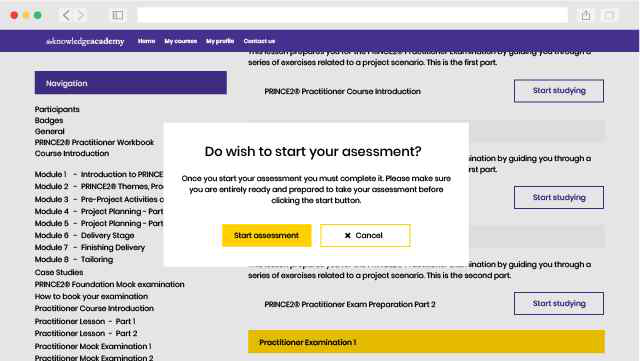

Our easy to use Virtual platform allows you to sit the course from home with a live instructor. You will follow the same schedule as the classroom course, and will be able to interact with the trainer and other delegates.

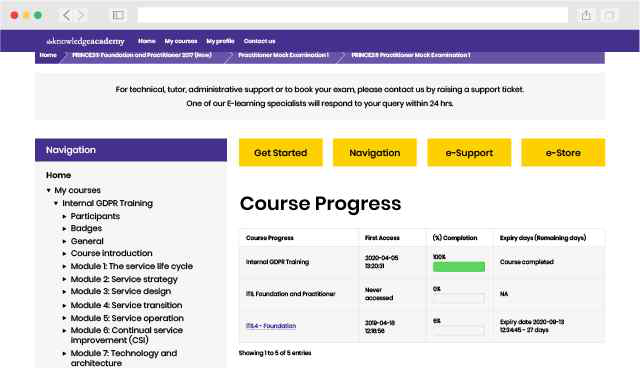

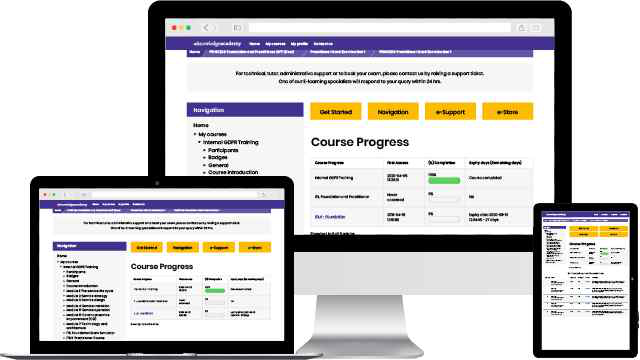

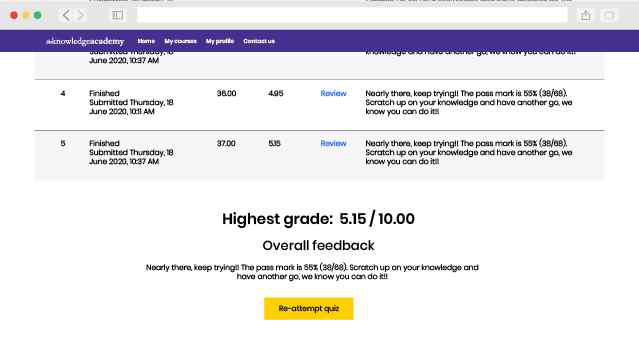

Our fully interactive online training platform is compatible across all devices and can be accessed from anywhere, at any time. All our online courses come with a standard 90 days access that can be extended upon request. Our expert trainers are constantly on hand to help you with any questions which may arise.

This is our most popular style of learning. We run courses in 1200 locations, across 200 countries in one of our hand-picked training venues, providing the all important ‘human touch’ which may be missed in other learning styles.

All our trainers are highly qualified, have 10+ years of real-world experience and will provide you with an engaging learning experience.

We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction-free as possible

We limit our class sizes to promote better discussion and ensuring everyone has a personalized experience

Get more bang for your buck! If you find your chosen course cheaper elsewhere, we’ll match it!

This is the same great training as our classroom learning but carried out at your own business premises. This is the perfect option for larger scale training requirements and means less time away from the office.

Our courses can be adapted to meet your individual project or business requirements regardless of scope.

Cut unnecessary costs and focus your entire budget on what really matters, the training.

This gives your team a great opportunity to come together, bond, and discuss, which you may not get in a standard classroom setting.

Keep track of your employees’ progression and performance in your own workspace.

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on 01344203999 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!