We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

close

Press esc to close

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information

Module 1: Sarbanes-Oxley Act

Module 2: Finance Auditing

Module 3: Committees

Module 4: Examples

Module 5: Internal Controls - COSO

Module 6: COSO Enterprise Risk Management

The Sarbanes-Oxley Certified Professional Course provides learners with the knowledge and skills they need to comply with the Sarbanes-Oxley Act (SOX). The professionals who can benefit from this course includes:

There are no formal prerequisites for this Sarbanes-Oxley Certified Professional Course.

The Sarbanes-Oxley Act (SOX) authorised strict reforms to improve financial disclosures from corporations and prevent accounting fraud. SOX compliance is the annual audit in which a public company has to give evidence of data-secured and accurate financial reporting. It has enhanced investor confidence and investors' accountability expectations for corporate officers and their legal as well as accounting experts. It benefits various organisations by providing them with a starting point for asset analysis. Adding Sarbanes-Oxley as a skill in learners' profiles will surely help them climb the ladder of success in terms of value and career opportunities.

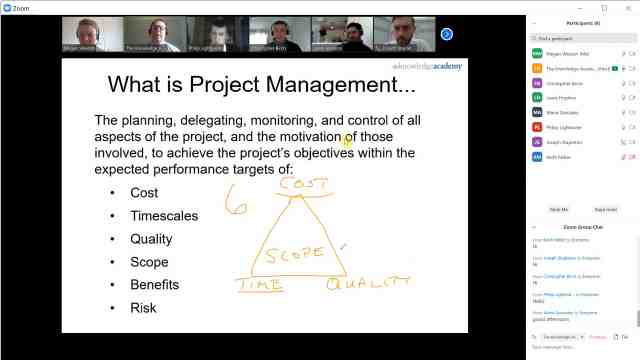

Our 3-day Sarbanes-Oxley Certified Professional Training course aims to provide delegates with a comprehensive knowledge of Sarbanes-Oxley (SOX). During this course, delegates will learn about electronic data gathering, analysis, and retrieval systems in finance auditing. They will also learn about various essential topics such as control deficiency, public disclosure requirements, types of IC, risk treatment plan, the structure of the business organisation, ERM framework, likelihood risk ranking, and many more. Our highly professional trainer with years of experience in teaching such courses will conduct this training course and will help you get a complete understanding of this course.

This training will also cover the following concepts:

At the end of this Sarbanes-Oxley Certified Professional Training course, delegates will be able to use the committee of sponsoring organisations' framework effectively. They will also be able to manage financial and enterprise risk properly without any issues.

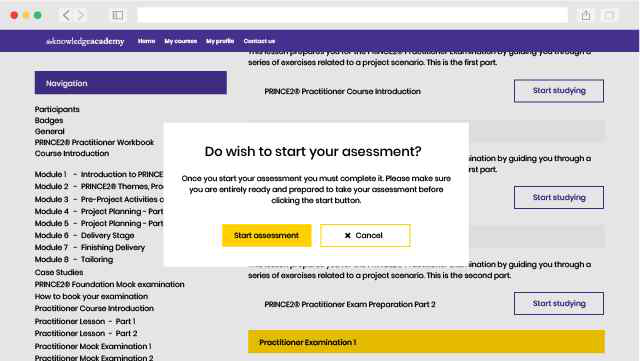

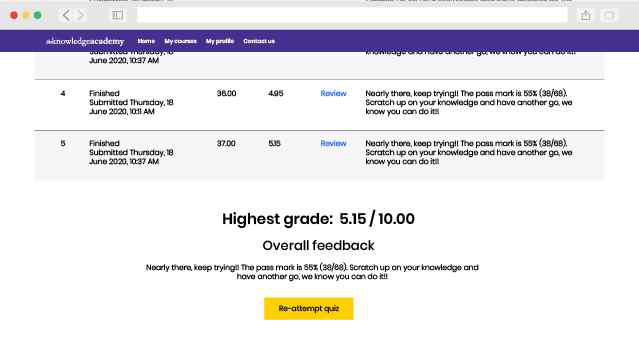

To achieve the Sarbanes-Oxley Certified Professional, candidates will need to sit for an examination. The exam format is as follows:

Why choose us

Our easy to use Virtual platform allows you to sit the course from home with a live instructor. You will follow the same schedule as the classroom course, and will be able to interact with the trainer and other delegates.

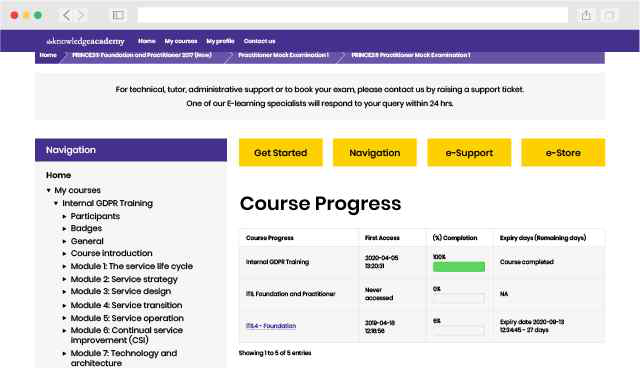

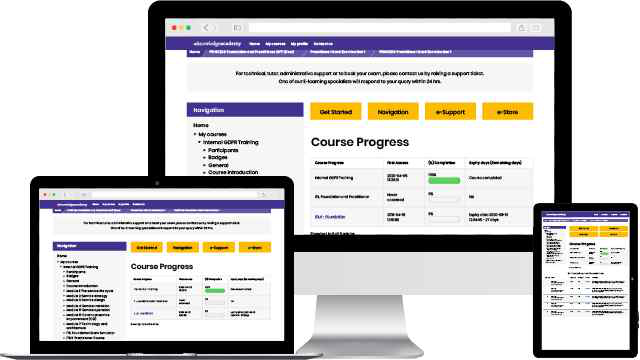

Our fully interactive online training platform is compatible across all devices and can be accessed from anywhere, at any time. All our online courses come with a standard 90 days access that can be extended upon request. Our expert trainers are constantly on hand to help you with any questions which may arise.

This is our most popular style of learning. We run courses in 1200 locations, across 200 countries in one of our hand-picked training venues, providing the all important ‘human touch’ which may be missed in other learning styles.

All our trainers are highly qualified, have 10+ years of real-world experience and will provide you with an engaging learning experience.

We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction-free as possible

We limit our class sizes to promote better discussion and ensuring everyone has a personalized experience

Get more bang for your buck! If you find your chosen course cheaper elsewhere, we’ll match it!

This is the same great training as our classroom learning but carried out at your own business premises. This is the perfect option for larger scale training requirements and means less time away from the office.

Our courses can be adapted to meet your individual project or business requirements regardless of scope.

Cut unnecessary costs and focus your entire budget on what really matters, the training.

This gives your team a great opportunity to come together, bond, and discuss, which you may not get in a standard classroom setting.

Keep track of your employees’ progression and performance in your own workspace.

Raj is fantastic, extremely knowledgable and brings a lot of experience to the course.

Course paced well. Any queries and questions were answered well.

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on 01344203999 and speak to our training experts, we should be able to help you with your requirements.

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!